Insights

Single Touch Payroll

What is Single Touch Payroll (STP)?

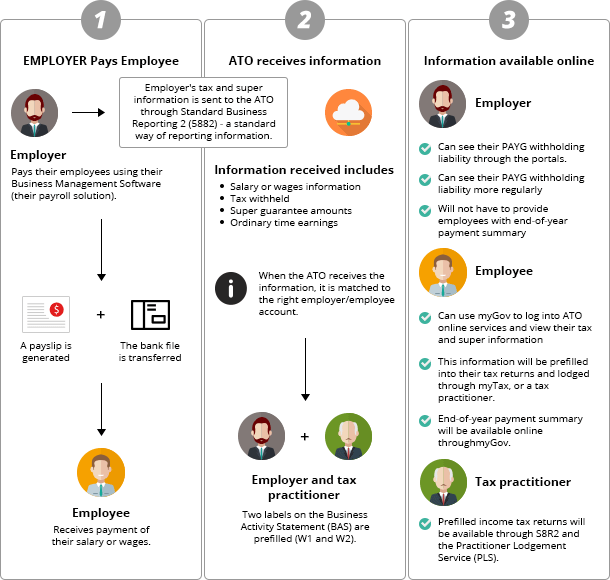

Single Touch Payroll (STP) makes payroll and tax reporting to the Australian Taxation Office (ATO) faster and more efficient through an online payroll system. STP is a new regulation that modifies when and how businesses report salary, PAYG and superannuation information. Instead of submitting annual reports, businesses are now required to send a report every time they pay employees.

Click here to learn everything you need to know about STP.

Why transition to STP?

It’s important to make the switch now. ATO requires all businesses with 19 employees or less to upgrade or replace their payroll solutions by 1 July 2019. What’s important here? The changes are coming, and there are penalties.

How will STP impact your business?

- Reduces end of financial year activities because you will no longer need to prepare and submit annual payment summary report

- Sending payment summaries to employees won’t be necessary anymore because they will be able to access their information via myGov

- Provides a more streamlined and efficient reporting to the ATO

- Enhances transparency between you and employees with regards to their financial information

How will STP impact your employees?

- Easier access to their tax and super information

- Gains transparency for their total year-to-date income, PAYG withholding amounts and superannuation contributions

- Reduces the risk of getting behind on superannuation entitlements or PAYG

When is the deadline for switching to STP?

As of 1 July 2018, all businesses with more than 20 employees are required to report their employees’ tax and superannuation information via STP. By 1 July 2019, businesses with less than 20 employees will need to switch to STP.

If you’re one of the thousands of businesses who need to replace or upgrade their payroll system to meet these obligations and still have little to go on, check out our helpful quick guide to Single Touch Payroll.

IMPORTANT INFORMATION: This blog has been prepared by Modoras Accounting (QLD) Pty. Ltd. ABN 81 601 145 215. The information and opinions contained in this blog is general information only and is not intended to represent specific personal advice (Accounting, taxation, financial, insurance or credit). No individuals’ personal circumstances have been taken into consideration for the preparation of this material. The information and opinions herein do not constitute any recommendation to purchase, sell or hold any particular financial product. Modoras Accounting (QLD) Pty. Ltd. recommends that no financial product or financial service be acquired or disposed of or financial strategy adopted without you first obtaining professional personal financial advice suitable and appropriate to your own personal needs, objectives, goals and circumstances. Information, forecasts and opinions contained in this blog can change without notice. Modoras Accounting (QLD) Pty. Ltd. does not guarantee the accuracy of the information at any particular time. Although care has been exercised in compiling the information contained within, Modoras Accounting (QLD) Pty. Ltd. does not warrant that the articles within are free from errors, inaccuracies or omissions. To the extent permissible by law, neither Modoras Accounting (QLD) Pty. Ltd. nor its employees, representatives or agents (including associated and affiliated companies) accept liability for loss or damages incurred as a result of a person acting in reliance of this publication. Liability limited by a scheme approved under Professional Standards Legislation.